by Service(s)

by Sector(s)

by Type

What is the profile of a CISO? Insights for tech marketers

July 1, 2025

Why summer is still a smart time for PR and Marketing in Dubai

July 8, 2025

A beginner’s guide to Generative Engine Optimization (GEO)

July 2, 2025

Aspectus Group Named Business-to-Business (B2B) Agency of the Year in Bulldog PR Awards

June 27, 2025

Getting AI to train your spokespeople

June 27, 2025

Top five global energy events: Tips and tricks

June 25, 2025

How to keep your brand and business strategy on-target with effective issues monitoring

June 24, 2025

Global Offshore Wind 2025: New headwinds bring new opportunities for the industry

June 19, 2025

The UAE’s attention crunch: Why smart comms strategies matter now more than ever

June 19, 2025

Surface-level impact: Why reputation alone won’t cut it for marketing industrial drilling firms

June 10, 2025

Infosecurity Europe 2025 marketing ideas / inspiration for next year

June 10, 2025

Is ‘data, power and water’ the new utilities trilemma?

June 4, 2025

3 corporate travel trends for 2025 – and how to turn them into PR and marketing wins

June 3, 2025

AI, empathy, and the future of marketing in 2025: 3 takeaways from Seamless Middle East

May 29, 2025

The top 3 CIO and CTO awards to enter in 2025

May 28, 2025

All Energy 2025: The power of storytelling in the UK’s energy transition

May 27, 2025

A lesson in public speaking dos and don’ts: one year since Rishi Sunak’s rain-soaked election speech

May 27, 2025

Dubai event season: How fintech brands can actually stand out

May 22, 2025

Top travel trade shows London 2025 – Key dates and details

May 22, 2025

25 years of TradeTech – the good, the bad and the road ahead

May 19, 2025

How not to catfish a journalist

May 15, 2025

Why your 2025 crisis communications plan must be ready before you need it

May 13, 2025

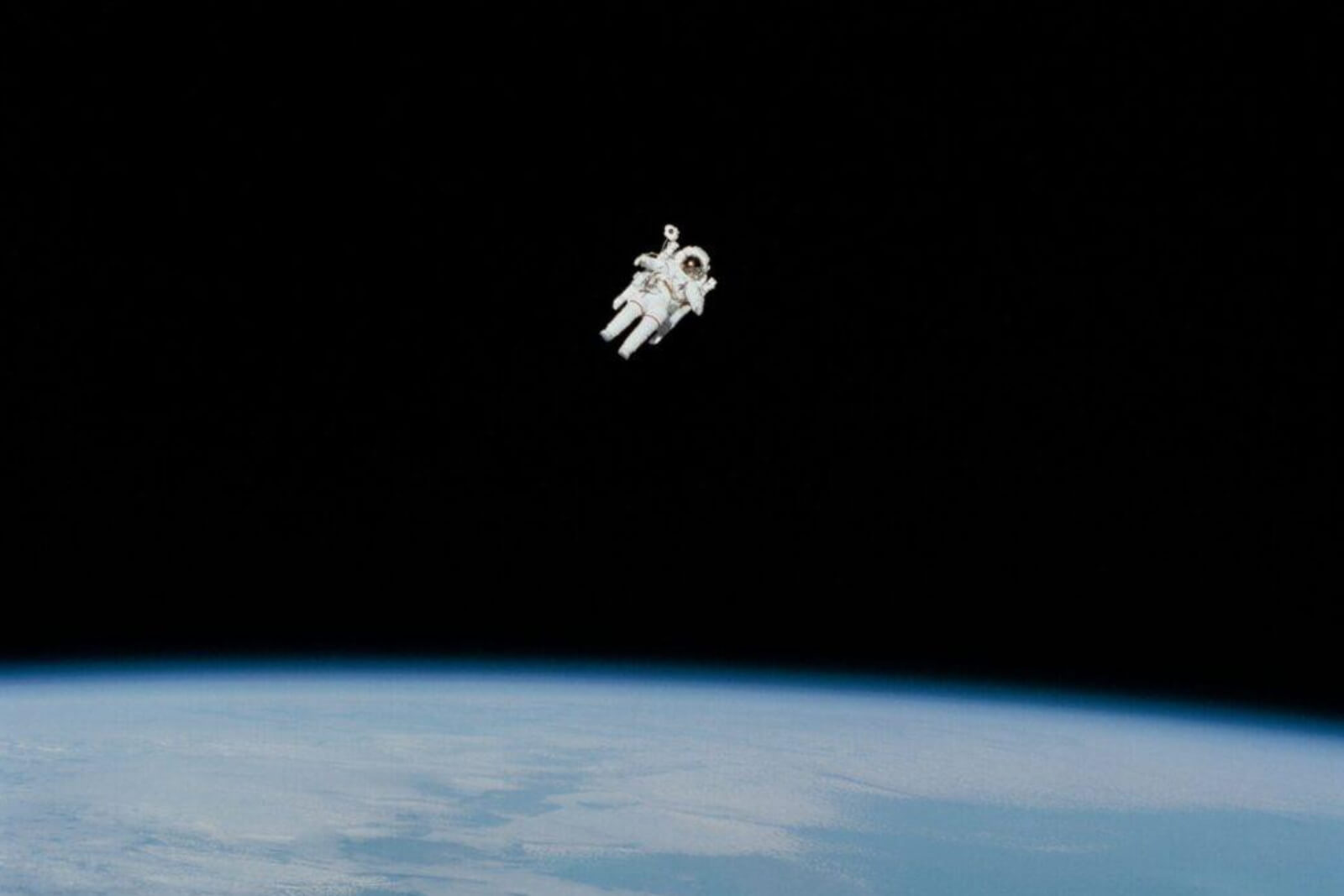

A newfound risk: extreme space weather?

May 8, 2025

When to revisit your brand strategy and messaging (and when to leave well alone)

May 7, 2025

Five things I learnt at Innovation Zero 2025: Standing out in a sea of innovation

May 1, 2025

Sifting Through the Noise: What HeroConf 2025 Revealed About PPC’s Next Chapter

April 25, 2025

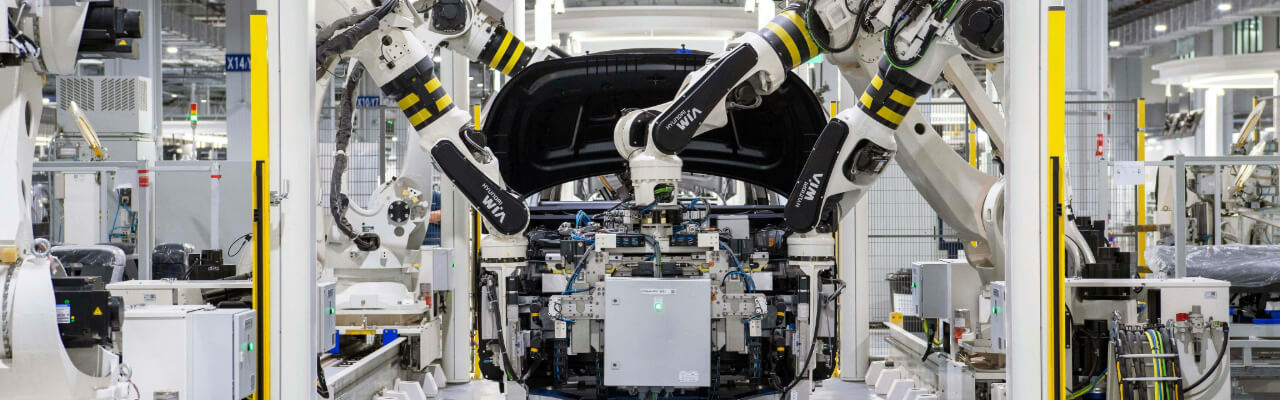

Industrial Robotics: How bad PR can stunt the growth of an advanced industry

April 24, 2025

The AI tsunami at brightonSEO and Hero Conf: Navigating the waves of change

April 23, 2025

Speak Local, Win Global: Why regional storytelling is key to global brand success

April 22, 2025

BrightonSEO 2025 recap: 5 proven SEO strategies amid AI uncertainty

April 17, 2025

Win big: Top telecom awards to enter in 2025

April 16, 2025

Lessons from The Masters: a masterclass in exclusivity branding

April 14, 2025

Communicating during challenging times, what can we learn from the UK’s oil and gas sector

April 14, 2025

Marcoms in 2025: Embracing the ins, eliminating the outs

April 3, 2025

Solving 2025’s Top Data and AI Challenges in Marketing

April 1, 2025

Hedge funds’ PR problem 15 years after The Big Short – and why it needs fixing

March 31, 2025

In boxing and beyond, the biggest brands leverage heritage to punch above their weight

March 13, 2025

Full throttle to net zero – Formula 1’s sustainability challenge

March 13, 2025

ESG in 2025: Everything Should Go?

March 13, 2025

Mastering newsjacking: Boost brand visibility and stay relevant

March 7, 2025

SOS! Tracking share of search – a smarter way to measure

March 7, 2025

Leave out the vowel or throw in the towel? It’s all about timing

March 7, 2025

Is building an underground town like in Disney+ series Paradise feasible?

February 20, 2025

Regional PR expertise is the new global power move – just ask HSBC

February 20, 2025

Building from the inside out: how company culture shapes B2B branding

February 20, 2025

Middle East family offices are thriving – here’s how service providers can stay ahead

February 20, 2025

How data-driven PR could democratize Big data

February 20, 2025

“You Can’t Handle the Truth!”: Why Traditional Journalism Matters in the Digital Era

February 19, 2025

How to market to CIOs in 2025

February 13, 2025

3 Lessons from My First Three Months as a PR and Marketing apprentice

February 13, 2025

Communications is key to capitalizing on trade finance opportunity as Trump tariffs loom

February 11, 2025

Marketing lessons from Guinness: what B2B brands can learn

January 31, 2025

PPC for B2B: Lessons from 2024, Plans for 2025

January 30, 2025

Snake Charm: Leveraging the Snake’s Finer Characteristics in PR and Communications

January 27, 2025

The Perfect Storm: Mastering PR for AI, Big Data & IoT Advancements

January 22, 2025

Rising government bond yields present stellar comms opportunity

January 22, 2025

How “considered creativity” can win battles with audiences and approvers

January 21, 2025

PR and marketing for Bett 2025 – your complete guide

January 15, 2025

To speak or not to speak: the art of opinion timing

January 14, 2025

B2B Digital Marketing Trends to Watch in 2025

January 8, 2025

Financial News journalist joins Aspectus Capital Markets as content strategy director

January 7, 2025

Beyond the exchange: strategic comms will distinguish leaders from laggards as data-strategies dominate

January 7, 2025

Communicating B2B ESG in the Middle East

December 18, 2024

Communicating ESG in APAC

December 5, 2024

Top Tips for Crypto Communications

December 3, 2024

Communicating ESG in the UK

November 27, 2024

ChatGPT turns two: why asset managers shouldn’t put all their eggs in the AI basket

November 27, 2024

Is Your Website ESG-Proof? Why Carbon-Conscious Web Design Matters

November 26, 2024

Communicating ESG in Financial Services & Capital Markets

November 20, 2024

Was Private Equity’s Successful Lobby for Gentler Tax Hikes a Masterclass in PR?

November 19, 2024

3 mistakes to avoid during Singapore’s event season

November 14, 2024

Communicating ESG in B2B tech: what professionals really think

November 13, 2024

Why B2B Brands in Complex Sectors Should Invest in YouTube Ads

November 12, 2024

Communicating ESG in B2B Energy: what professionals really think

November 6, 2024

Top 5 LinkedIn Ad Products for B2B Marketing Success in 2024

October 30, 2024

Will AI replace public relations? What business leaders need to know

October 23, 2024

How to capture the attention you don’t deserve: rethinking B2B marketing for complex industries

October 10, 2024

Singapore Fintech Festival: How to thrive, not just survive

October 9, 2024

How to modernise your telecom marketing strategy for success

September 26, 2024

What Telecoms Can Learn from the Oasis Reunion PR Fallout

September 20, 2024

Tech Week Singapore 2024: 6 tips for event success

September 17, 2024

What Do Clients Want from Their Marketing Agency in 2024?

September 11, 2024

How to grow your business in Asia

September 10, 2024

Scotland’s energy future under a Labour government

September 5, 2024

Marketing Cybersecurity Solutions: Top 5 Strategies for 2024

August 28, 2024

Best Cybersecurity Awards for 2025: Entry Deadlines & Tips

August 20, 2024

From Memes to Money: How Gen Z is Redefining Marketing

August 7, 2024

Communicating ESG: What do marketeers really think?

July 31, 2024

Rebranding regrets: a deep dive of Abrdn and why it absltly bombed

July 30, 2024

Cutting through a crowded room: The power of thought leadership in the Middle East

July 25, 2024

Whitepaper – Marketing ESG in 2024: Risks, Rewards & Riddles

July 23, 2024

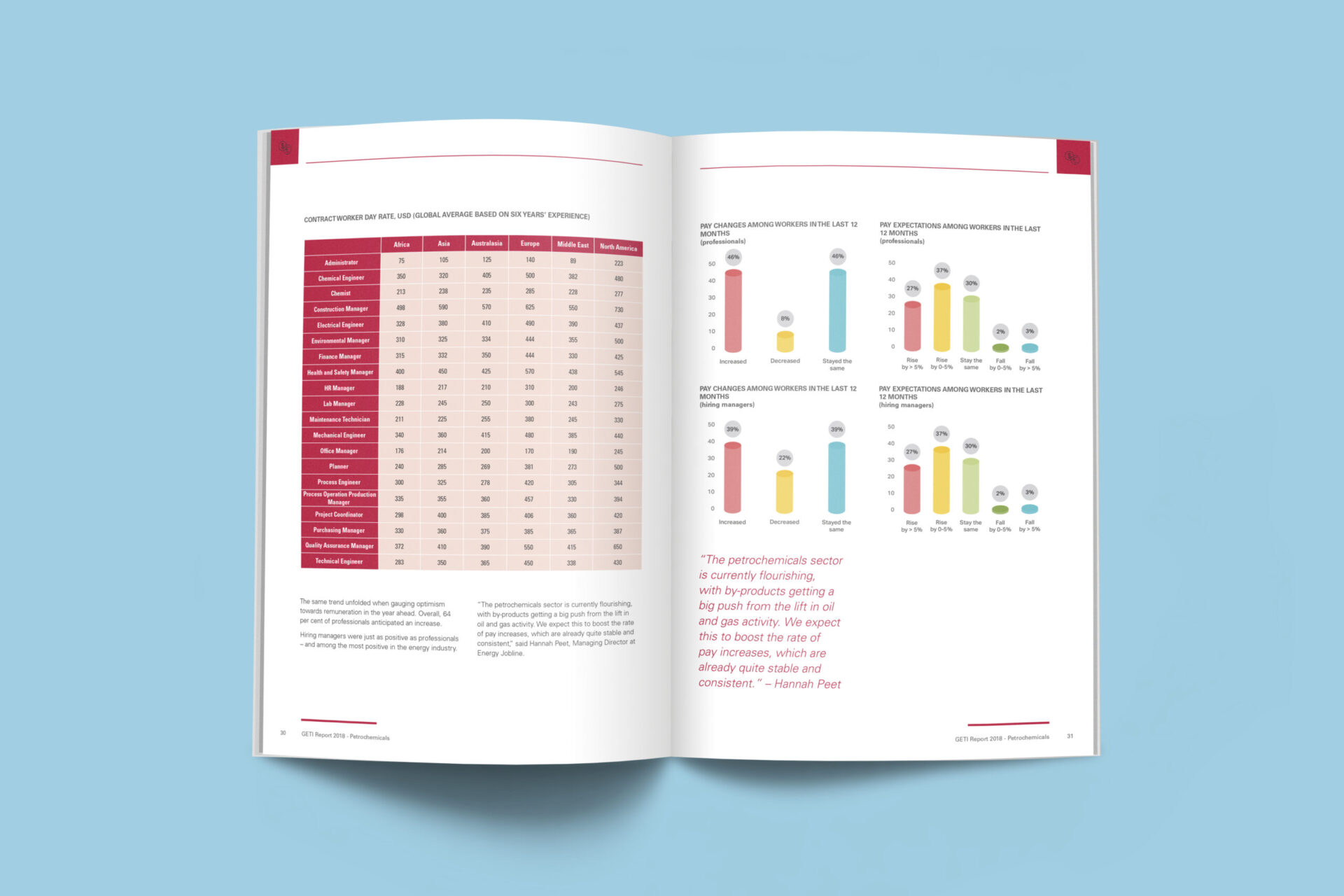

Bringing Data to Life

July 11, 2024

The importance of crisis communications in a general election

July 3, 2024

Six key takeaways from EBAday 2024

July 3, 2024

“But Does it Apply to B2B?” Assessing B2C marketing approaches in a B2B world

June 12, 2024

How to write a research report

June 5, 2024

Webinar Replay – Marcoms in Asia: What Businesses Need to Know Now

June 4, 2024

Aspectus Group expands into Middle East with Dubai office opening

June 4, 2024

What global markets can learn from Asia’s unique ESG approach

May 29, 2024

A perfect partnership: My love affair with AI

May 16, 2024

Webinar – Marcoms in Asia: What Businesses Need to Know Now

May 15, 2024

Aspectus: Celebrating our success as 2024’s B2B PR Agency of the Year and a top workplace

May 14, 2024

Money20/20 Bangkok: should you attend next year?

May 10, 2024

How strategic communications can take the UAE’s fintech fever to new heights

May 3, 2024

Four key considerations for capturing asset managers’ attention at TSAM

April 30, 2024

The Monzo Effect: How a fintech became a verb for Gen Z

April 25, 2024

21 E-E-A-T Strategies To Supercharge Your SEO And Boost Brand Trust

March 28, 2024

Communication and compliance: how regtechs can stand out in a growing market

March 18, 2024

IWD: celebrating a few of many

March 7, 2024

The art of strategic focus in marketing: what we can learn from Freddie Mercury

February 28, 2024

Everything You Need to Know About Google Consent Mode v2

February 27, 2024

More realistic targets and clear, consistent comms are the only route out of greenwashing

February 22, 2024

Top technology awards to enter in 2024

February 20, 2024

A confident continent: Asian Marcom Professionals buoyant on growth and omnichannel evolution

February 1, 2024

Whitepaper – Marcom in Asia: A confident continent

January 31, 2024

Around the world in 80 seconds: navigating cultural differences in a global agency

January 29, 2024

Rolling out the red carpet: a comprehensive list of the best B2B energy awards to enter in 2024

January 22, 2024

ROI of PR: Tracking strategic communications to business success

January 12, 2024

Executive communications & an investment bank’s CEO side hustle

December 20, 2023

Aspectus appoints professional services lead

December 11, 2023

Don’t let the data drown out your voice of reason: the subtle balance of art and science in marketing strategy

December 8, 2023

Internal threat data: your key to cybersecurity media success

November 7, 2023

Always-on: your protection against the triple forget threat

October 26, 2023

Hold that thought – why marketers need to stop having so many new ideas

October 17, 2023

Aspectus celebrates stellar growth

September 26, 2023

How to write a B2B website brief

September 26, 2023

How professional services firms can edge out the competition this Q4 by refreshing communications strategies

September 22, 2023

Lehman Brothers 15 years on: why communication is king

September 15, 2023

Measuring What Matters: Missteps in Marketing Reporting (and how to fix them)

September 5, 2023

Webinar – ESG Communications in South East Asia

July 28, 2023

Unlocking the Power of GA4: Harnessing Events and Custom Reports for Data-driven Insights

July 20, 2023

When green bonds turn brown: Thames Water kicks up a stink

July 13, 2023

Mastering B2B SaaS marketing: choosing channels and media for optimal success

July 11, 2023

The $4trn question: why it pays to invest in your brand assets

July 5, 2023

Why the time to ignite tech communications in Singapore is now

July 4, 2023

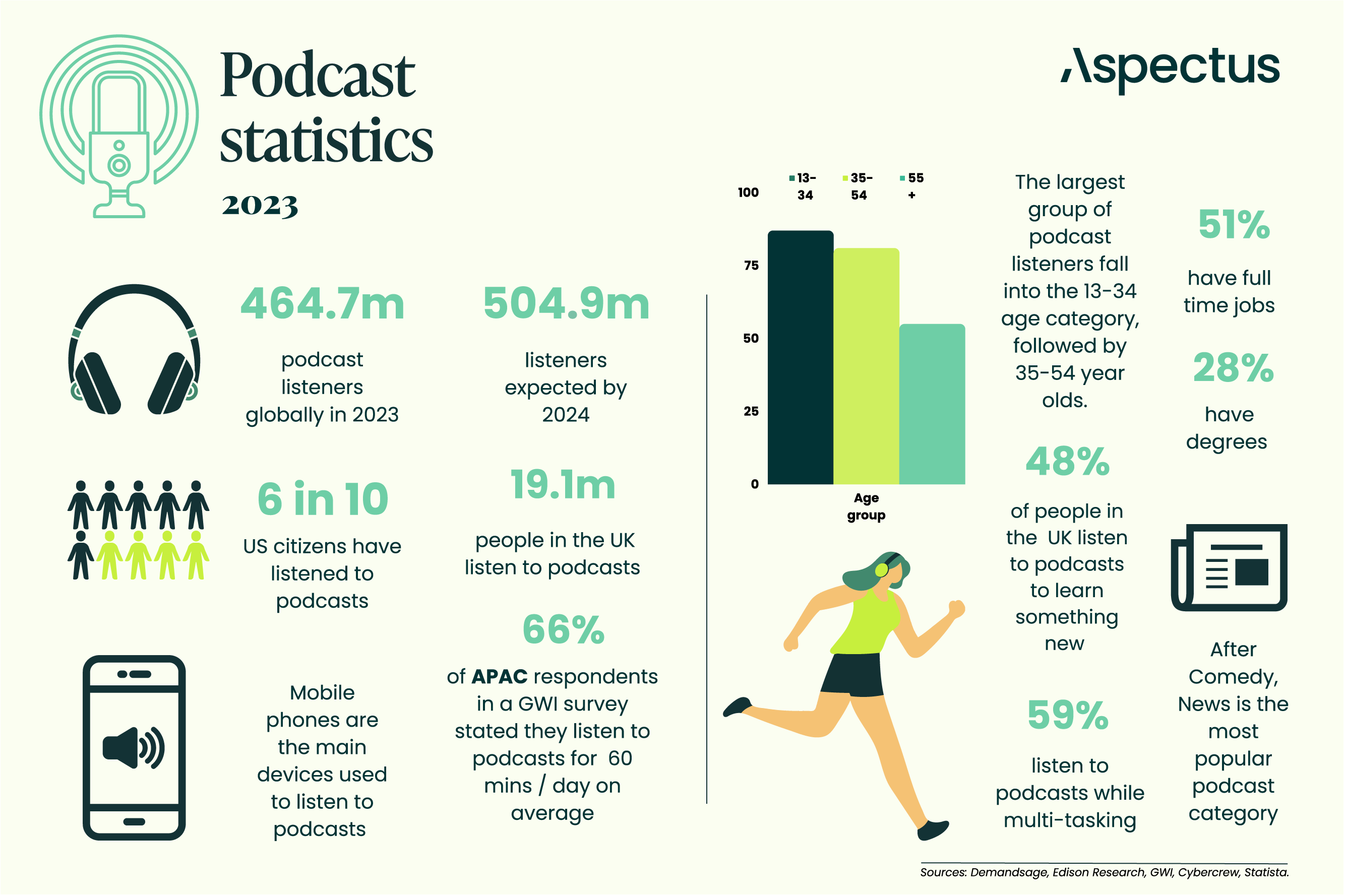

5 reasons why podcasts are a powerful add to your content strategy

July 4, 2023

Selling brand investment to the Board: a guide for marketing managers

June 28, 2023

5 ways to future proof your marketing communications strategy in Asia

June 26, 2023

Step up your SaaS marketing game: top tips for knowing your audience

June 14, 2023

3 top tips for developing an effective technology event communications plan

May 19, 2023

Why we care more about bad news… and how spokespeople can cut through

May 19, 2023

Breaking Fast and Breaking Barriers: A Guide to Celebrating Ramadan in the Workplace

May 17, 2023

Poor comms strategy? You’re fired: how the candidates should have played their cards in this year’s ‘The Apprentice’

May 11, 2023

The democratisation of the internet: how Web3.0 can correct the mistakes of Web2.0

May 10, 2023

Unleashing The Potential of Onshore Wind: Insights from the UK’s first onshore wind conference

May 10, 2023

Why a PR and marketing career is just like a half marathon

May 10, 2023

GDPR: 5 years of Compliance and Impact

May 9, 2023

The Pursuit of Excellence

May 3, 2023

Insight unleashed: rediscovering the real magic behind the buzzword and harnessing its value in a data-driven world

April 25, 2023

There is no magic formula in marketing, but we think we have cracked the code

April 18, 2023

Whitepaper – ESG comms: threading the needle

March 28, 2023

Singapore: Asia’s Silicon Valley

March 16, 2023

The nuclear-sized hole at the heart of the green hydrogen vision

March 15, 2023

A PR Playbook for B2B Techs Expanding into the US

March 14, 2023

From the Tiger’s Unrest to the Rabbit’s Respite: How 2023 Promises Calm and Confidence in Capital Markets

March 9, 2023

Singapore: Switzerland’s secret admirer

March 6, 2023

Spotlight on: Singapore and the Energy Transition

March 1, 2023

From the Government’s big mini-budget to Labour’s big lead

February 26, 2023

5 tips to break into broadcast across Asia-Pacific

February 22, 2023

3 Key learnings from 3 months in PR

February 21, 2023

The blue economy: don’t fall into the buzzword trap at this year’s Subsea Expo

February 13, 2023

Can we bridge the divide between local communities and onshore wind developers?

February 8, 2023

DFS: Less about sofas and more about smart grids

February 6, 2023

3 reasons why an apprenticeship is the perfect steppingstone for a career in PR and digital marketing

February 3, 2023

Emerging trends for 2023 in the B2B marketing space (insights from the B2B Marketing Expo)

January 30, 2023

ESG communications: don’t try and keep up with the Joneses… but do keep an eye on them

January 4, 2023

Clarity is key: when advertising campaigns go wrong

December 16, 2022

The future of B2B social media marketing: an insight into Elon Musk’s chaotic Twitter takeover

December 15, 2022

IoT PR: there’s still plenty of room on the IoT bandwagon

December 14, 2022

Will Singapore be the New Hub for Green Finance?

December 12, 2022

It’s not just France v England on the pitch we should be looking at this weekend

December 8, 2022

Advice from an Apprentice – it’s tough, but you’re tougher

December 7, 2022

How to write a brief for a brand and marketing agency

December 6, 2022

Musings on mussels; and a sea of possibility

November 30, 2022

Four chancellors and a funeral: navigating communications and the media

October 26, 2022

The lesson in sustainability communications that banks must learn from Icarus

October 25, 2022

“And the award goes to” … Why B2B awards should be a key component of your marketing plan

October 18, 2022

Four energy communications constants in a world of climate chaos

October 12, 2022

What those with a PR and marketing career learn from dating apps

October 6, 2022

From the Government’s big mini-budget to Labour’s big lead: A defining week for UK politics and public affairs – Part 2

October 4, 2022

From the Government’s big mini-budget to Labour’s big lead: A defining week for UK politics and public affairs – part 1

October 3, 2022

GA4 migration: planning a smooth transition

September 26, 2022

Let’s ‘BeReal’ about how to build brand awareness and attract talent

September 22, 2022

Media training: How do the Tory leadership election candidates stack up

September 2, 2022

Cooling cities: regrowing our urban green spaces

August 17, 2022

ESG comms: sincerity can silence sceptics

August 1, 2022

Can Aberdeen become the Net Zero Capital of Europe?

July 22, 2022

How can we bridge the gap until the energy transition?

July 14, 2022

A guide to integrated PR and marketing for edtech companies

July 13, 2022

How to grow your SaaS business

June 15, 2022

We need to change our relationship with energy

June 14, 2022

Why is media relations important? Lessons from Covid-19 and beyond

June 1, 2022

Electric Vehicles: A look forward on growth in 2022

May 25, 2022

Why LME’s publicity pain reinforces the need for humble comms

May 23, 2022

Knowing your ABCs – navigating the ESG world

May 17, 2022

Why a magic catherine wheel is responsible for our ongoing success

May 13, 2022

Can Aberdeen really transition from oil and gas?

May 12, 2022

Yin and Yang – Digital Marketing and PR: An Integrated Approach for Success

May 10, 2022

CEO PR: Celebrity Executive Officer or Chief Executive Officer?

April 28, 2022

Technology awards: a comprehensive list of the best to enter

April 27, 2022

Paris in the Spring: Ensuring business blossoms at TradeTech Europe

April 25, 2022

Why proactive reputation management is pivotal for hedge funds

April 21, 2022

Energy efficiency: the forgotten friend in the decarbonisation debate

April 8, 2022

Fintech PR: the five lessons learnt during my first three months

March 30, 2022

What International Women’s Day means to us

March 11, 2022

Tips for how to ace an interview

March 10, 2022

To PR or not to PR: that is no longer a question in modern football

March 1, 2022

Is fintech still “stuck in Shoreditch”? … (and the role of fintech marketing in growth)

February 25, 2022

Losing your head in 2022: the latest CMS trend

February 22, 2022

You’ve got InMail: an update on LinkedIn’s changes to native sponsored messaging

February 11, 2022

Changes at the pump: The EV mindset

February 10, 2022

Why you don’t need a degree to have a career in comms

February 9, 2022

Top-down regulation will undermine public support for green energy

January 13, 2022

Aspectus hires PAM Insight editor to expand wealth management communications service

January 12, 2022

The balancing mechanism: What is it and why is it so expensive?

December 8, 2021

Comms without strategy: an expensive stroll to nowhere

November 16, 2021

Helping clients compete with considered creativity

November 16, 2021

Press preparation: fluster free media interviews

November 16, 2021

Traditional is top but integrated is better

November 16, 2021

We won’t ask you to make the news to be in the news

November 16, 2021

The thrill of cartoons

November 16, 2021

Net-Zero by 2070: How is India decarbonising its energy production?

November 15, 2021

Info for teachers: The Aspectus Academy and our talks, workshops and career days

November 10, 2021

Getting off the ground: the initial hurdles as an EdTech startup and how to overcome them

November 9, 2021

Why the uncertain future of Euro-denominated swaps is a goldmine for comms

November 2, 2021

Can’t stand the heat? Get out the kitchen: can finance executives mirror as pro bakers?

October 26, 2021

Selling net zero: Is that enough?

October 20, 2021

Smarter, not more: Demand side response and the winter crunch

September 8, 2021

Generation Greenwashing: the shaming of hollow ESG policies

September 2, 2021

The Power of the List: why listicles are invaluable tools in a PR strategy

August 24, 2021

Transactions or data: Can LSEG have their cake and eat it?

August 18, 2021

ESG: Balancing E, S & G factors for a truly just transition

August 12, 2021

Once more with feeling: why has the IPCC Sixth Assessment report resonated more deeply this time?

August 11, 2021

Overbond selects Aspectus for European PR

August 10, 2021

The Aspectus Academy: everything you need to know

August 2, 2021

3 critical lessons for marketing to insurance leaders

August 2, 2021

The Aspectus Academy: webinar

July 5, 2021

It’s hotting up: The race to decarbonise heat

July 5, 2021

A pandemic-induced acceleration for impact investing – and why Communications is crucial

June 22, 2021

Andy Haldane became the media darling of economics, the Bank of England must continue his legacy

June 22, 2021

Aspectus wins six new tech clients

June 16, 2021

The Energy Transition: A Coming-of-Age Story

May 24, 2021

The game is on!

May 20, 2021

The growing importance of user experience in search engine optimisation (SEO)

May 19, 2021

Greenwashing: distinguishing between the cynical and the naïve

May 19, 2021

Fund managers – investors need to hear from YOU!

May 19, 2021

Mental Health is complex – but time can do wonders

May 13, 2021

Have we reached Peak Survey? No – but the bad ones abound.

May 13, 2021

6 Reasons Your PR Plan isn’t Working

May 1, 2021

Aspectus elevates two senior team members to joint MD

April 29, 2021

Lessons from abrdn – the tricky business of rebranding

April 27, 2021

Appearances are often deceiving: being creative about supporting virtual conferences

April 27, 2021

The rising technology stars taking the world by storm

April 7, 2021

How PR can help VC’s raise funding

March 12, 2021

ITV and Piers Morgan: nobody is bigger than the brand

March 10, 2021

When the fun stops, GameStop

March 3, 2021

How to pitch to tech journalists in 2021

March 2, 2021

#20from2020: reflecting on the highlights of the year

February 25, 2021

Social media for tech companies: What to share and when

February 24, 2021

Why capital markets startups should channel a bit of GameStop in their PR

February 17, 2021

The Aspectus Bookshelf: Impact by Sir Ronald Cohen

February 11, 2021

Aspectus appoints Edelman alumni Astrid Dickinson to lead expansion into industrials

January 11, 2021

Why scale-ups shouldn’t aim for national media coverage

January 6, 2021

Tim’s top five interview gaffes of 2020

January 4, 2021

Why the ghost of a storytelling past is at the heart of BBC investment banking thriller

December 16, 2020

Why HR tech companies should consider newsjacking as part of their PR plan

November 27, 2020

Top edtech trends for 2021

November 18, 2020

Why financial institutions should be engaging a different count this week

November 6, 2020

Aspectus creates new role to add firepower to its strategic services and rigour to its client service

November 6, 2020

Your next job doesn’t have to be in cyber

October 13, 2020

Bad news done badly ft. Shell and Arsenal FC

October 8, 2020

The future of the grid: Is COVID-19 a crystal ball?

August 25, 2020

Judging the time to strike: newsjacking for maximum impact

August 13, 2020

There’s an app for that: the essential PR toolkit

August 12, 2020

Mining for ESG data – the new gold of the financial information industry?

August 4, 2020

What is integrated marketing communications?

July 30, 2020

How to market a product with no competition

July 20, 2020

The femtech revolution: women first, finally

July 13, 2020

Social distancing hobbies – FS team edition

June 16, 2020

How – and how not – to handle a brand reputational crisis

June 11, 2020

Effective thought leadership: what makes a good report?

June 10, 2020

Avoiding herd communication: How impact investing companies can stand out in an increasingly busy market

May 21, 2020

How to market your business during COVID-19: six actionable tips

May 18, 2020

Social distancing hobbies – energy team edition

May 14, 2020

Fund managers: now is the time to make your voices heard!

May 11, 2020

Starting my first PR job (remotely) during COVID-19

May 4, 2020

A moment of truth: How a crisis reveals your true company culture

May 1, 2020

COVID-19: the ups and downs of life as a virtual media trainer

April 30, 2020

Aspectus Group launches Capital Markets division as earnings hit £1 million

April 29, 2020

The US team’s guide to sparking joy in quarantine

April 22, 2020

Webinar: Positive positioning – marketing your business during COVID-19 and beyond

April 17, 2020

Social distancing hobbies: tech team edition

April 7, 2020

Reaching its peak: Energy storage’s potential

March 16, 2020

Aspectus appoints Melissa Jones as Integration Account Manager in Technology Practice

March 10, 2020

How businesses can create their own podcasts – part 3

February 17, 2020

Mind the measurement gap: stating the case for PR measurement & reporting

February 11, 2020

The best business podcasts: telling engaging stories (while also making commutes bearable) – part 2

February 10, 2020

The best tech podcasts: telling engaging stories (while also making commutes bearable) – part 1

February 3, 2020

Zuckerberg’s new year’s resolutions, circa 2020

January 17, 2020

How an ace AR (augmented reality) application earned ASOS attention

January 16, 2020

What having a ‘gong bath’ taught me about communicating

January 13, 2020

The right horse, the wrong jockey: why Facebook’s Libra has a PR problem

November 19, 2019

Storytelling for impact: four key lessons in impact investing comms

November 18, 2019

Why the oil and gas industry might be facing its Kodak moment

October 9, 2019

Surprising similarities between Hamilton and PR

October 3, 2019

Aberdeen: so much more than oil and gas

September 2, 2019

Intern’s Guide: How to Take a Brief

August 23, 2019

Intern’s Guide: How to Write a Blog Post

August 23, 2019

Fuelling the future: EVs

July 23, 2019

No more FOMO: the magic of missing out

June 18, 2019

Under the Influence: How much power do social influencers actually have?

May 9, 2019

Further growth for global communications agency in Aberdeen

April 2, 2019

Are you a polyglot? The benefits of international PR and marketing

March 18, 2019

The energy transition – how ready is the oil and gas sector?

February 16, 2019

BackOffice Associates appoints Aspectus as its UK and EMEA agency

November 8, 2018

Aspectus appoints Claire Wych as energy practice expands

July 24, 2018

How to impress an Evening Standard journalist

June 21, 2018

OpenGamma appoints Aspectus to run its UK communications

June 14, 2018

Light at the end of the oil barrel perhaps?

May 30, 2018

PR – know what you want to achieve

April 30, 2018

Aspectus Group’s energy earnings hit £1m mark on anniversary of Aberdeen launch

April 25, 2018

Acoustic Data hires Aspectus to drive brand growth

April 19, 2018

Impact investing: tackling the doom and gloom!

April 19, 2018

Did no one tell the London Stock Exchange that digital life would be this way?

April 13, 2018

A focus on wellness

February 28, 2018

The future of mobile marketing

February 13, 2018

PennWell chooses Aspectus for inaugural Electrify Europe event

December 13, 2017

Aspectus promotes Tim Focas to capital markets lead

November 21, 2017

Regtech innovator Meritsoft appoints Aspectus to run its global communications

November 3, 2017

The rise of influencer marketing

August 30, 2017

breatheHR appoints Aspectus as its UK communications agency

June 27, 2017

InnoEnergy retains Aspectus to drive engagement across Europe for third year running

June 22, 2017

ZoneFox appoints Aspectus as its UK communications agency

April 10, 2017

Five ways to make a name in blockchain

January 25, 2017

Aspectus appoints Annabel Rivero to financial services team

January 17, 2017

Emerald Life selects Aspectus for integrated communications

January 10, 2017

Aspectus and Fidessa celebrate eight year PR partnership anniversary

December 13, 2016

Aspectus offers communications support to Swiss Finance Startups (SFS) members at preferential rates

December 6, 2016

The lunch remains the same: The enduring importance of the journalist lunch

November 23, 2016

EuroFinance selects Aspectus to run the media relations for European treasury event

October 5, 2016

Aspectus appoints new head of energy, oil and gas

August 30, 2016

Ayming appoints Aspectus to support business expansion

July 15, 2016

Cavendish Asset Management selects Aspectus to run external communications

March 20, 2016

Aspectus opens Aberdeen office

March 9, 2016

Europe’s fastest-growing online stock broker, DEGIRO, selects Aspectus

December 10, 2015

The seven ages of business marketing: From startup to exit

October 27, 2015

Aspectus unveils new approach for driving engagement through communications

June 16, 2015

Aspectus wins SABRE Award for work with ITG

May 20, 2015

Aspectus PR to manage PR for Sustainability Live

February 17, 2014

Aspectus adds Institute of Engineering and Technology to growing list of Event PR Clients

October 15, 2013

Aspectus PR appointed for new biometrics brief

August 14, 2013

Aspectus PR launches Big Issue Invest Corporate Social Venture Challenge

May 7, 2013

Sherborne Sensors selects Aspectus PR for international public relations campaign

August 16, 2010

Aspectus PR wins Fidessa group account

May 14, 2009

Aspectus Appointed for launch of Glenigan Business Market Intelligence

October 27, 2008